Investing is one of the most effective ways to grow your wealth over time. However, with so many investment options available, it can be overwhelming to choose the right plan. This guide will break down different investment plans, their benefits, risks, and how to get started—ensuring you make informed financial decisions.

Table of Contents

- What is an Investment Plan?

- Why Should You Invest?

- Types of Investment Plans (With Benefits & Risks)

- Stocks

- Bonds

- Mutual Funds

- Fixed Deposits (FDs)

- Real Estate

- Gold and Precious Metals

- Public Provident Fund (PPF)

- National Pension System (NPS)

- Systematic Investment Plans (SIPs)

- Cryptocurrencies

- How to Choose the Right Investment Plan?

- Risk vs. Reward in Investments

- Steps to Start Investing

- Common Investment Mistakes to Avoid

- Final Thoughts

1. What is an Investment Plan?

An investment plan is a strategy that helps individuals allocate their money into different financial instruments to achieve specific financial goals. These goals could include:

- Wealth creation

- Retirement planning

- Buying a house

- Funding education

- Generating passive income

A well-structured investment plan considers factors like risk tolerance, investment horizon, and financial objectives.

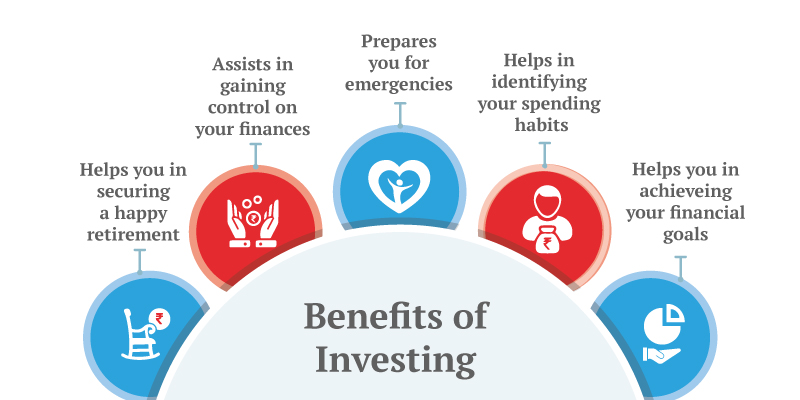

2. Why Should You Invest

Here are key reasons why investing is essential:

a) Beat Inflation

- Benefit: Investments (like stocks, real estate) grow faster than inflation, preserving purchasing power.

- Example: If inflation is 6% and your FD gives 5%, you’re losing value. Stocks historically return 10-12%, beating inflation.

b) Wealth Creation

- Benefit: Compounding (earning returns on returns) accelerates growth.

- Example: Investing ₹10,000/month at 12% for 20 years = ₹1 crore+.

c) Financial Security

- Benefit: Diversified investments protect against emergencies (medical, job loss).

- Example: Rental income from real estate can cover expenses if you lose a job.

d) Passive Income

- Benefit: Earn without active work (dividends, rent, interest).

- Example: ₹50 lakh in bonds at 7% = ₹3.5 lakh/year passively.

3. Types of Investment Plans (With Benefits & Risks)

a) Stocks

- Benefits:

- High returns (10-15% historically).

- Liquidity (sell anytime).

- Ownership in growing companies (e.g., dividends from Infosys).

- Risks:

- Volatile (prices swing daily).

- Company bankruptcy risk.

b) Bonds

- Benefits:

- Stable income (fixed interest).

- Safer than stocks (government bonds are low-risk).

- Risks:

- Lower returns (~5-7%).

- Default risk (if issuer fails).

c) Mutual Funds

- Benefits:

- Professional management.

- Diversification (spreads risk).

- SIPs allow small, regular investments.

- Risks:

- Market-linked (can lose value).

- Fees (expense ratio).

d) Fixed Deposits (FDs)

- Benefits:

- Guaranteed returns.

- Safe (insured up to ₹5 lakh in India).

- Risks:

- Low returns (~5-6%).

- Penalty on early withdrawal.

e) Real Estate

- Benefits:

- Tangible asset.

- Rental income + appreciation.

- Tax benefits (home loans).

- Risks:

- Illiquid (hard to sell quickly).

- High maintenance costs.

f) Gold and Precious Metals

- Benefits:

- Hedge against inflation.

- Safe during crises.

- ETFs make it easy to invest.

- Risks:

- No passive income.

- Prices fluctuate.

g) Public Provident Fund (PPF)

- Benefits:

- Tax-free returns (~7.1%).

- Government-backed (safe).

- Risks:

- Long lock-in (15 years).

- Low liquidity.

h) National Pension System (NPS)

- Benefits:

- Tax savings (₹50,000 extra under 80CCD(1B)).

- Good for retirement (market-linked returns).

- Risks:

- Partial lock-in till retirement.

- Equity exposure = some risk.

i) Systematic Investment Plans (SIPs)

- Benefits:

- Disciplined investing.

- Rupee-cost averaging (buy more when prices drop).

- Risks:

- Market risk (like all equities).

j) Cryptocurrencies

- Benefits:

- High return potential (e.g., Bitcoin surged 1000%+ in 5 years).

- Decentralized (no bank control).

- Risks:

- Extreme volatility (can drop 80% in months).

- Unregulated (scam risk).

4. How to Choose the Right Investment Plan?

Match investments to your:

- Goal Timeline:

- Short-term (1-3 years) → FDs, debt funds.

- Long-term (10+ years) → Stocks, real estate.

- Risk Tolerance:

- Conservative → PPF, bonds.

- Aggressive → Crypto, small-cap stocks.

- Tax Efficiency:

- ELSS (tax-saving mutual funds).

- NPS (extra ₹50k deduction).

5. Risk vs. Reward in Investments

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | 10-15%+ |

| Mutual Funds | Moderate | 8-12% |

| FDs | Low | 5-7% |

| Crypto | Very High | 50-100%+ (or -80%) |

Rule: Higher risk = higher reward (but also higher chance of loss).

6. Steps to Start Investing

- Set Goals (e.g., “₹1 crore in 15 years”).

- Emergency Fund First (3-6 months’ expenses in FDs).

- Start Small (e.g., ₹500/month SIP).

- Diversify (mix stocks, bonds, gold).

- Review Yearly (adjust as needed).

7. Common Investment Mistakes to Avoid

- Waiting Too Long: Starting at 25 vs. 35 can mean 2-3x more wealth due to compounding.

- Emotional Decisions: Selling stocks in a crash locks in losses.

- Overconcentration: Putting all money in 1 stock or crypto is risky.

8. Final Thoughts

Investing is not just for the rich—anyone can start with ₹500/month. The key benefits?

- Beat inflation (grow money faster than prices rise).

- Create wealth (via compounding).

- Financial freedom (passive income, early retirement).

Next Steps:

- Open a demat account (for stocks) or SIP (for mutual funds).

- Consult a financial advisor if unsure.

Remember: The best time to invest was yesterday; the second-best is today!